Unlocking Real Estate Riches: With Mogul Club Partnership

At CMCK Enterprises, we're always on the lookout for innovative platforms that make property investment more accessible and rewarding to everyone. That's why we're excited to share our experience with Mogul Club Partnership, a game-changer in the world of fractional real estate investing.

Mogul Club Partnership is revolutionizing how individuals access institutional-grade real estate opportunities. Founded by former Goldman Sachs real estate professionals, the platform aims to democratize wealth creation through fractional ownership of high-quality, income-generating properties. This means you no longer need millions of dollars to get your foot in the door of lucrative real estate deals.

What truly sets Mogul Club Partnership apart is their commitment to transparency, quality, and impressive returns. They pride themselves on a rigorous vetting process, analyzing properties based on population growth, shifts, and employment data to identify those with the highest upside. The team personally invests in every property listed, aligning their interests directly with yours.

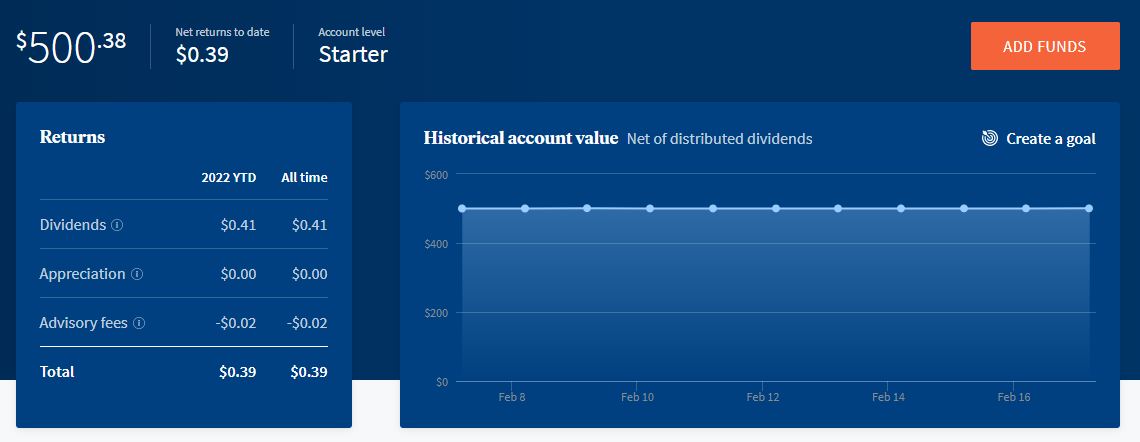

The platform's ease of use is another major plus. You can start investing with as little as $250 in professionally managed single-family rentals. In less than 30 seconds, you can own a piece of a property and begin generating passive income through monthly dividends. Investors also benefit from real-time property appreciation and significant tax advantages. Mogul Club reports an impressive average annual return (IRR) of 18.8% as of April 30, 2025, with monthly yields often in the 12-14% range.

Beyond individual investments, Mogul Club has introduced "Clubs," which foster community-driven investing. Friends, families, or even online communities can pool resources and invest together, making real estate not just a financial endeavor but a collaborative journey. This innovative approach brings a social dimension to wealth building, empowering groups to learn and earn collectively.

While real estate investments inherently involve some illiquidity, Mogul Club has plans to introduce a secondary liquidity option in the second quarter of 2026, which will be a welcome development for investors seeking more flexibility. Until then, the focus remains on the long-term appreciation and consistent rental income.

In a market where traditional real estate investing can feel out of reach for many, Mogul Club Partnership truly stands out. They offer a legitimate, accessible, and high-potential pathway to building real estate wealth. If you've been looking to diversify your portfolio with real estate without the heavy lifting, Mogul Club is definitely worth exploring.

Ready to start your real estate investment journey? Use our referral link and get a head start! When you invest, you and your friend each receive $50 in credits.

Legal Disclaimer:

The information provided in this article is for informational purposes only and does not constitute financial, investment, or legal advice. CMCK Enterprises, LLC is not a licensed financial advisor. All investments carry risks, including the potential loss of principal. Past performance is not indicative of future results. Readers are encouraged to consult with a qualified financial advisor or conduct their own research before making any investment decisions.

.png)